Further enhance your role as a trusted advisor

Deepen SME relationships with BankiFi, from co-branded services dedicated to your customers to referring them for working capital finance.

Going beyond banking

Transforming relationships with small businesses is the answer to mutual growth and keeping you ahead in a competitive market. At BankiFi, we provide the core banking technology, data and services that drive customer-centricity and address the real needs of SMEs.

Have a branded everyday touchpoint with your customers

Generate revenue through your relationships

OUR CUSTOMERS

£22 billion

That’s what The Bank of England estimates to be the small business funding gap in the UK. As trusted advisors to small businesses, you can help to bridge this gap by providing finance solutions that help your SME customers grow.

But how?

Partnering with BankiFi allows banks to offer SMEs services to pay, get paid, manage their cashflow and access lending in a cost-effective way that leads to profitable relationships.

“BankiFi has enabled us to deliver our shared vision of supporting micro businesses and SMBs”

Darrell Evans,

The Co-operative Bank PLC

Transforming

The Co-operative Bank’s offering

The Co-operative Bank chose us to gather engagement marketing data to inform their SME business banking strategy. How? We built a dedicated internet banking channel through their pay and get paid solution, driving new customer acquisition, adoption and repeat usage.

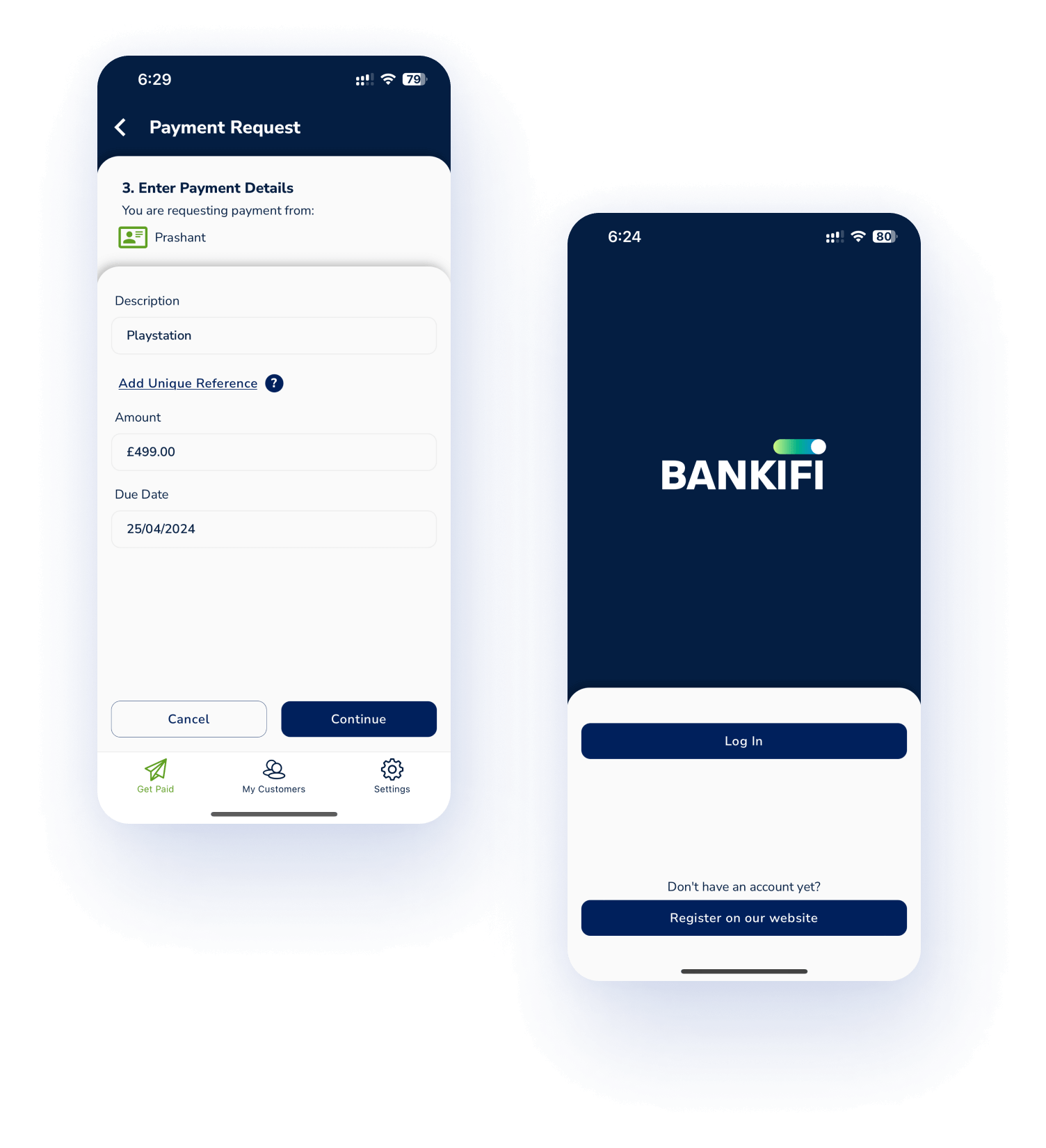

But how does it actually work?

In the UK, collecting money takes an average of 71 days when invoicing terms are 30 days. That equates to 54.6 million hours per year of businesses chasing late payments.

BankiFi enables banks to automate collections for your customers within your digital channel, reducing late payment days and hours spent on admin. Data from our solutions show small businesses are getting paid in just two days.

Automation is the answer, removing hours of admin time and the risk of human error.

BankiFi links bank accounts and accounting packages to automate matching and reconciliation, saving your customers time and money.

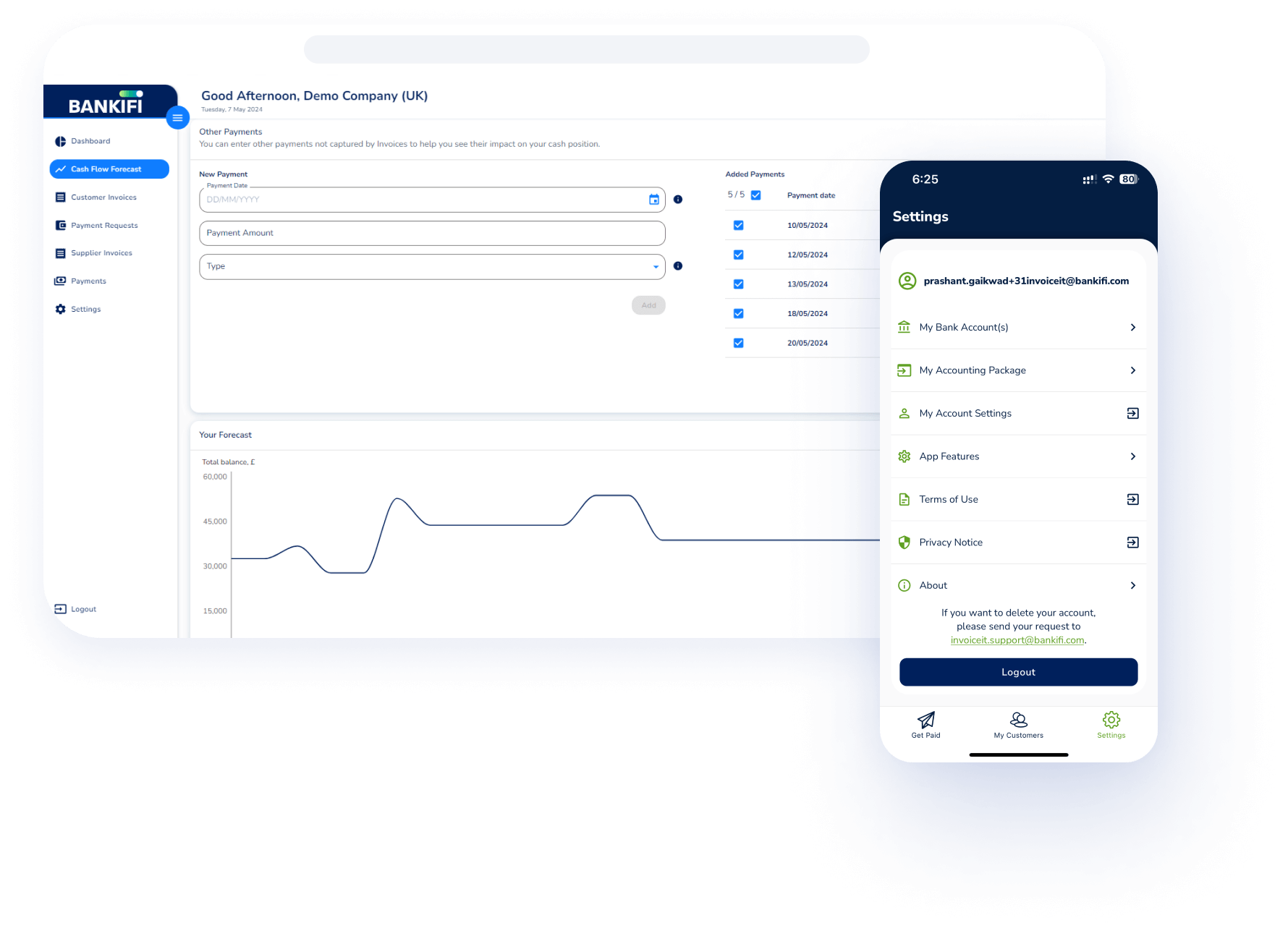

It’s a common pain point for SMEs. Banks should be well placed to help, but don’t have the access to the technology or data to do so.

BankiFi holds the keys. Using data from bank accounts and accounting packages, BankiFi builds a live profile of your customers’ cash positions, allowing greater visibility to make better business decisions. All the while, banks have access to invaluable data to shape future business decisions.

54% of SME lending in the UK comes through brokers, and banks aren’t funding the £22 billion gap.

With 71% of SMEs not meeting eligibility criteria and 56% deemed too risky, our lending-as-a-service solution removes that risk and enables quick and easy lending within a bank-branded channel.

Often, processes happen across multiple applications, which can be a headache.

Instead, we make the workflow seamless. BankiFi enables the entire process from within a bank's digital channel, embedding you in their day-to-day activities.

This includes things like bookkeeping, linking accounting packages or, if they don’t have one, using bank-branded native invoicing services within the solution.

This creates relationship primacy between you and the SME and builds a customer profile that can support proactive lending and more.

Customers are often forced to use channels that don’t fit their needs, with no consistent experience across those channels.

We replace the siloed approach with an API-first solution. Our ‘gig to big’ model helps you to acquire customers at the earliest and cheapest point in their journey, so they never need to look elsewhere.

You’re one step away from boosting SME relationships

Book your demo today to see first-hand how Bankifi can help diversify your offering and tap into new customers. Are you ready? See BankiFi’s tech in action.

The BankiFi blog

White paper: Ready to discover what's next in business banking?

Insights on the future of Financial Services - from digital challengers to mainstream banks The business banking landscape is no longer...Webinar: Is beyond banking the new everyday banking?

Beyond Banking, Beyond Expectations: Why Banks Must Act Now to Win Small Businesses In a world of fast-moving fintechs, challengers and...The Future of Payments: BankiFi Features in Capgemini Report

The Future of Payments: BankiFi’s Solutions Featured in Capgemini’s 20th Anniversary World Payments Report We are delighted to share that...Explore more

Our solutions

From the innovative core banking technology to the marketing and engagement services that bring it all together, we’ve got it covered.

Why BankiFi?

We’re focused on helping banks transform their relationships with small businesses. Uncover what we mean by engagement banking as a service.

.png)

.png?width=600&name=Rectangle%20316%20(3).png)

.png?width=600&name=Webinar%20assets%20(1).png)