Transforming

The Co-operative Bank’s offering

🏆 Winner of the 2025 Celent Model Bank Award for Best Open Banking Innovation

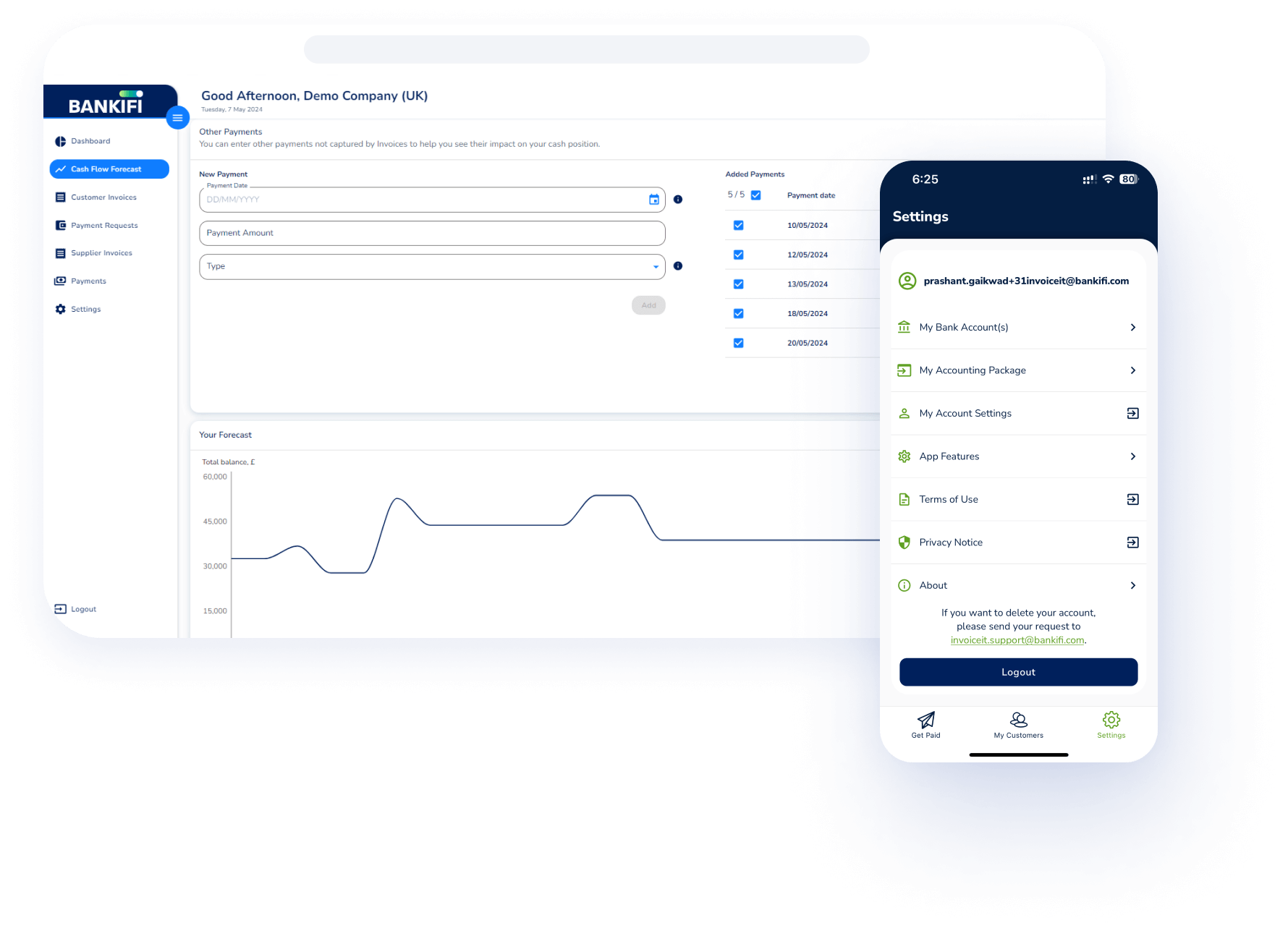

The Co-operative Bank chose us to gather engagement marketing data to inform their SME business banking strategy. How? We built a dedicated internet banking channel through their pay and get paid solution, driving new customer acquisition, adoption and repeat usage.

.png)

.png?width=600&name=Rectangle%20316%20(3).png)

.png?width=600&name=Webinar%20assets%20(1).png)