SMBs and Banks: What's the situation?

Historically, banks have offered standardized financial solutions to small and medium-sized businesses (SMBs) without thought for their specific needs and challenges.

While many banks perceive themselves as pivotal in their relationships with SMBs, recent data suggests a different perspective. For example, in 2022 non fintech providers like Quickbooks provided $933M in loans to 70% of North American SMBs, which was considerably higher than the lending figure in 2021, which was $232M. These digital challengers and specialized financial providers have played a significant role in extending financing to SMBs, significantly impacting the lending landscape.

Source: Forbes

The Growth of the Gigs

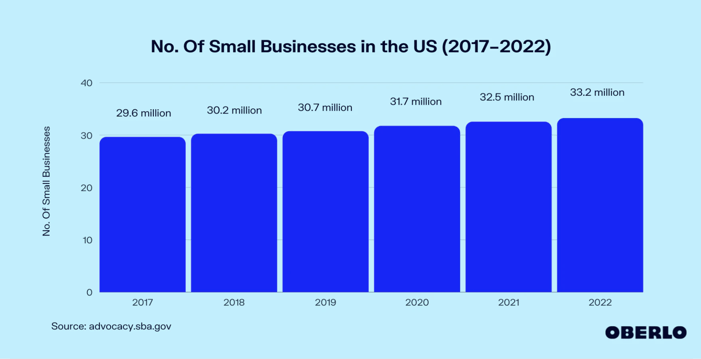

In the United States, nearly half of all employees, totalling 61.7 million workers, are employed by small businesses. Among the 33.2 million small businesses, 80% consist of sole proprietors with no employees. The gig-worker landscape has increased by a giant 5 million businesses in the last 12 months, which is a significant milestone.

This rapidly growing segment of gigs presents a clear-cut growth avenue for traditional banks and financial institutions. However, gigs and smaller SMBs continue to be underserved by these incumbent banking institutions. This is largely due to the fact that SMBs require tailored tools and resources that are specific to their needs and workflow-centric mindsets. Traditional banks and financial institutions have historically, and continue to, have a product-centric approach as opposed to placing priority on the consumer. The products that they are currently providing SMBs simply aren't meeting their requirements, so not only are the SMBs losing out, but the banks are too. Fortunately, this landscape is evolving to address this gap.

SMBs Cannot Be Siloed

The gig landscape is increasing year on year. In fact, it's estimated that by 2027, more than half of the US workforce will be gig workers. With this rapid growth, the time has come for banks to reassess how they categorize gig workers and SMBs so that they can provide them with tailored solutions that meet their needs and solve their pain points.

Incumbent banks and financial institutions have typically siloed Gigs and SMBs into a one-pot-wonder. Their understanding here is that these business customers can fit into one category and be served via solutions that way. However, it's widely acknowledged that the SMB sector is unique: No two businesses are the same, nor do they have the same needs, wants and challenges.

Non-fintech payment providers and accounting platforms appear to have smelled the coffee before traditional banks have even woken up. These challenger banks are beginning to provide SMBs with tailor-made solutions that align with their workflow way of thinking (e.g. from order-to-cash and procure-to-pay), making it easier for them to effectively do business.

The Edge of the Challengers

In a study conducted by Bain & Company, nearly two dozen business owners shared that they managed their business finances via software applications, such as Quickbooks or Xero.

This research supports the rise in popularity of challengers amongst Gigs and SMBs, given the fact the traditional bank/financial institution does not provide them with products that actually solve their pain points - such as the issue of late payments and the impact this has on their cash flow.

If such cash flow challenges continue to go unresolved, this may lead to the breakdown of the SMB and its closure. In fact, only 25% of new businesses successfully thrive for 15 years or more. (The Bureau of Labor Statistics).

Bain's research underscores that the most valuable assets for SMBs are accounting and payment platforms enriched by data and that provides them with a holistic overview of their business's financial health. These platforms have cemented the 'challengers' position in the SMB market by crafting digital experiences tailored to functions that are crucial to the survival of gigs and SMBs; such as cash flow management and finance management.

The Mindset Shift Necessary for Traditional Banks

It's essential that banks begin to recognize the 'golden opportunities' that gigs and SMBs can provide them. They need to start implementing solution-based strategies that will help them serve these customers - both future and existing - better.

Scanning Bain's report, we've compiled three key learnings that banks should take on board in order to place them on a path towards success where their SMB customer relationships are concerned.

Each point below addresses aspects that can make a huge difference in enhancing the banking experience for SMBs, ultimately curating growth and mutual success.

👏 Putting Customers First: Crafting an Intuitive User ExperienceIn the world of banking for gigs and SMBs, prioritizing the customer is paramount. One of the key lessons is to ensure that your user interface (UI) is designed with the same intuitive ease found in leading consumer platforms. This means going beyond traditional banking services. The outcome? An intuitive and user-friendly experience that not only automates operations but also minimizes friction for both gigs/SMBs and their clientele.

🛠️ The Challenge of Disconnected SystemsGigs and SMBs frequently find themselves involved in laborious manual processes. These can be cumbersome, time-consuming, and prone to errors, particularly when managing tasks such as accounts receivable/payable, invoice tracking, and accessing data across various databases and platforms.

To overcome these challenges, banks must prioritize the integration and automation of diverse data sources. This entails synchronising data from accounts receivable/payable, invoice tracking, and other sources. The ultimate goal is to reduce reliance on manual intervention and bring in a more efficient and streamlined approach to data management.

By embracing integrated data solutions, banks can help gigs and SMBs to increase productivity, accuracy, and responsiveness, while also positioning themselves for growth.

📲 Enabling Extensibility for SMB FlexibilityA crucial aspect for gigs and SMBs is the ability to incorporate multiple functions that are critical to their survival. Banks should empower these businesses to expand functionality through seamlessly integrating third-party applications that help solve the SMB’s biggest pain points. By developing cohesive offerings such as these, banks can enhance their relevance amongst the gig and SMB landscape.

In fact, forward-thinking banks might even consider expanding their services beyond traditional banking to support SMBs in running their businesses. For instance, a freelance marketing agent could reap significant advantages from streamlined invoice creation, rapid payment processing, and convenient at-a-glance cash flow forecasting tools to enhance financial planning.

As the SMB sector continues to grow, it becomes evident that only banks willing to shift their approach from product-centered to customer and data-centered strategies will be well-positioned to harness this growth potential.

Hear more from BankiFi

If you'd like to receive updates and insightful content from us directly into your inbox, sign up to our newsletter to get your BankiFi fix.

.png)

.png?width=600&name=Rectangle%20316%20(3).png)

.png?width=600&name=Webinar%20assets%20(1).png)