What SME bankers can learn from the recent Bain NPS Consumer Banking study: “In Search of Customers Who Love Their Bank”.

The Dutch financial daily Het Financieele Dagblad alerted me this week to a new and very relevant study by Bain about NPS and whether customers trust their bank, banks in general or BigTech more. 29% of the respondents trust at least one big tech more than their own primary bank, and 54% trust at least one big tech more than banks in general.

I was curious to see in how far the open banking FinTech/BigTech debate had reached the minds and the behaviour of the consumers and I can only suggest you have a look for yourself, the results make for compelling reading.

A business banking client – with consumer behaviour: Gig and Small Business

So here’s a thought. In a world where more and more young people live an independent professional life and become part of the Gig economy with a mixed life of business and personal goals and needs, we should no longer just put them in the SME ‘segment’, as bankers tend to do. “Everyone in its pigeon hole so we can run our business more efficiently”. Moreover, it is generally accepted that the SME segment has always been “the pig in the middle”, small in terms of revenue, large in terms of time and cost allocation, risky, diverse and – and this is important – behaving like consumers whilst running a business. SME customers are by their very nature customers that need a holistic approach as personal and financial goals are often intertwined. To be fair, compliance and regulation dictated that even the most willing banks were forced to treat them separately as businesses with all the formality that entails.

So, now that technology enables us to offer simple, secure, time saving solutions and the regulation allows us to share and consume data that allows banks to offer meaningful combined services – what can banks learn from consumer behaviour in a Gig and SME world?

How to make sure those customers do not opt for the BigTech propositions that are coming their way or the isolated – but often profitable – app based solutions from an ever expanding fintech community. Banks can stay very relevant and have a profitable relationship with Gigs and SMEs once they approach them as a business with consumer style behaviour and holistic needs.

A few lessons here that I read between the lines:

Lesson 1 – quality first, but also save time, simplify, reduce my anxiety

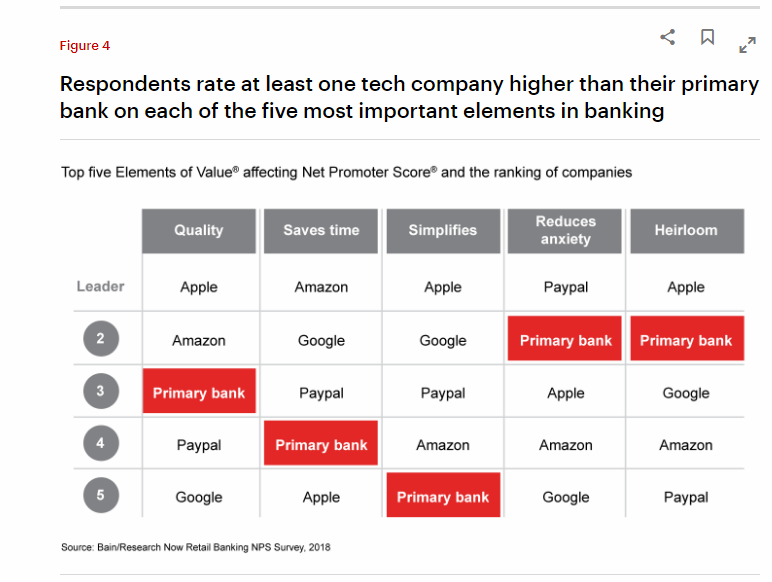

Entrepreneurs in the Gig and SME segment are ‘retail customers’ with a busy business lifestyle. What they like and don’t like in private is reflected in business. As we see in the study and figure 4 above, the elements that most impact their loyalty in banking are quality, saves time, reduces anxiety, simplifies and heirloom (or for want of a better word, a good investment towards the future). For business customers this can easily be translated into sticky propositions.

Under Open Banking and PSD2, banks must be able to do much better for their business banking customers in terms of ‘saving time’ by for example combining data from accounting packages with account information and offering time saving tips on cashflow or lending. Or go even further and the bank can generating invoices from the same accounting packages (or their own business banking account) and collect monies on behalf of the entrepreneur. ‘Simplifies’ is achievable if only you start designing from the customer perspective around a need, rather than digitising a bank process. It is also impressive to see that pure loyalty factors around trust – reduced anxiety and a lasting relationship –score relatively well for the banks. It is still there, but must be harvested now and there is no shame in copycatting the convenience and customer experience approaches from big tech and mobile. Go simple, go digital – save time!

Lesson 2 – be prepared and ready for collaboration – and not just with partners

“In areas such as payments, they may have to join together in multibank platforms”, as per the study. In areas where volume and low costs matter most, cooperation is a great way to go. In the past it would have been unthinkable that banks would share ATMs, but we see this trend emerging rapidly. In my home country the Netherlands we have many collaborative initiatives like the foundation under our payments infrastructure called Ideal, which enables the very fast innovation of initiatives like “Tikkie”, pay your share by mobile/what’s app where it is safe to say to with all the participating banks, consumers do not know who the ‘founder/owner’ (ABNAMRO) was. Everybody wins. This attitude can be extrapolated to the Gig economy (by the way,’Tikkie’ is seriously challenging eCommerce/card payments within the Gig economy as it is invoicing and receiving payment in one click) and SME. Reaching out for a more satisfied SME community works for every bank and saves money and more importantly prevents the non-banks from nestling themselves in the heart of your customers and nibble away at their loyalty towards you. The Gigs of today could be tomorrow’s corporate and private banking customers.

Lesson 3 - offer service level and usage based packages

A n earlier Bain survey shows that 65% of Amazon Prime respondents (who pay an annual fee for such perks as free two-day shipping) would try a free online bank account offered by Amazon, with 2% cash back on Amazon purchases, similar to the company’s cobranded credit card. Like consumers who are willing to pay extra for speed or convenience (choice of delivery time), Gig entrepreneurs will be of the same mind set. They do understand that time is money and offering a discount on early payment on invoices can be translated into banking services too. Early repayment of a loan might entice the lender to more often go for a short term loan as it is now perceived to be a ‘fair deal’.

n earlier Bain survey shows that 65% of Amazon Prime respondents (who pay an annual fee for such perks as free two-day shipping) would try a free online bank account offered by Amazon, with 2% cash back on Amazon purchases, similar to the company’s cobranded credit card. Like consumers who are willing to pay extra for speed or convenience (choice of delivery time), Gig entrepreneurs will be of the same mind set. They do understand that time is money and offering a discount on early payment on invoices can be translated into banking services too. Early repayment of a loan might entice the lender to more often go for a short term loan as it is now perceived to be a ‘fair deal’.

Lesson 4 – NPS = loyalty = offer connected journeys, not products

If you as a bank outperform on more than one value point with your customers, on average your NPS score will be twice as high. As per figure 4, banks will have to close the larger gaps on 'quality' (satisfier by a huge margin), 'saves time' and 'simplifies'. The lesson here is that if you want to score across more than one element as a bank for SME and Gig customers, you must leave the ‘product’ domain and think in critical business journeys of your customers and link the separate ‘episodes’ and take out the friction. A business selects you as a banking partner and wants to get going. What he today receives in return for that trust is jargon: “we have to on-board you”, separate unconnected data sources and a lot of hassle, rather than a ‘welcome pack’ sensation. These are typically areas where having the fundamentals in place matters most: a fine-grained consent model so you can repurpose data with minimum fuss yet full transparency. Mobilise a team to focus on those areas where personal and business needs overlap for the Gig customer and build bridging journeys with those five value items in mind.

If you as a bank outperform on more than one value point with your customers, on average your NPS score will be twice as high. As per figure 4, banks will have to close the larger gaps on 'quality' (satisfier by a huge margin), 'saves time' and 'simplifies'. The lesson here is that if you want to score across more than one element as a bank for SME and Gig customers, you must leave the ‘product’ domain and think in critical business journeys of your customers and link the separate ‘episodes’ and take out the friction. A business selects you as a banking partner and wants to get going. What he today receives in return for that trust is jargon: “we have to on-board you”, separate unconnected data sources and a lot of hassle, rather than a ‘welcome pack’ sensation. These are typically areas where having the fundamentals in place matters most: a fine-grained consent model so you can repurpose data with minimum fuss yet full transparency. Mobilise a team to focus on those areas where personal and business needs overlap for the Gig customer and build bridging journeys with those five value items in mind.

Lesson 5 – Small banks can be successful too, and loved

T he Bain survey also points to the fact that despite our current focus on the big banks and the ‘BigTech’ threat, there is a good case for looking the other side – opportunities galore for smaller banks and niche financial institutions. In America, USAA thrives in terms of loyalty and high NPS scores for it has a deadly focus on customer quality. Similarly Live Oak Bank, Fifth Third and again USAA took even two awards home this year at BAI’s Global Innovation Awards, demonstrating that the more nimble organisations are often very capable of delivering a digital, yet human service that hits the spot with their customers. In a similar vein, smaller FIs or niche lending or financing organisations can bring great innovations to the Gig and SME customer base.

he Bain survey also points to the fact that despite our current focus on the big banks and the ‘BigTech’ threat, there is a good case for looking the other side – opportunities galore for smaller banks and niche financial institutions. In America, USAA thrives in terms of loyalty and high NPS scores for it has a deadly focus on customer quality. Similarly Live Oak Bank, Fifth Third and again USAA took even two awards home this year at BAI’s Global Innovation Awards, demonstrating that the more nimble organisations are often very capable of delivering a digital, yet human service that hits the spot with their customers. In a similar vein, smaller FIs or niche lending or financing organisations can bring great innovations to the Gig and SME customer base.

Entrepreneurs will opt for financial services around their business needs delivered in a manner that fits their busy daily lives: fair, simple, secure, time saving and fit for future growth. With today’s technology and the open banking/PSD2 regulation banks and other service providers can offer just that – reaching out to lean in.

Ready to learn more?

Book a demo with our dedicated team and see how BankiFi can help put your bank at the heart of business.

Note: The focus of this study was the consumer banking side and from July to September 2018, the survey polled 151,894 respondent consumers of national branch network banks, regional banks, private banks, direct banks, community banks and credit unions from nearly 30 countries. Authors: Gerard du Toit, Partner Boston | Katrina Cuthell, Partner Sydney | Stanford Swinton, Partner London | Maureen Burns, Partner Boston

The BankiFi manifest:

Entrepreneurs need financial services around their business challenges delivered in a manner that fits their busy daily lives: fair, simple, secure, time saving and fit for future growth. With today’s technology and the open banking/PSD2 regulation banks and other service providers can offer just that – reaching out to lean in. BankiFi’s technology is the white-labelled solution for ‘banks that get it’, built today to last beyond tomorrow.

Beyond Open: entrepreneurs need and deserve it, banks can do it: BankiFi enables it.

.png)

.png?width=600&name=Rectangle%20316%20(3).png)

.png?width=600&name=Webinar%20assets%20(1).png)