.png?width=464&height=303&name=Rectangle%20313%20(1).png)

What do we do?

- Help small businesses get paid

- Help small businesses manage their cashflow

- Give small businesses access to working capital finance

- Make HMRC tax compliance seamless

PLATFORM

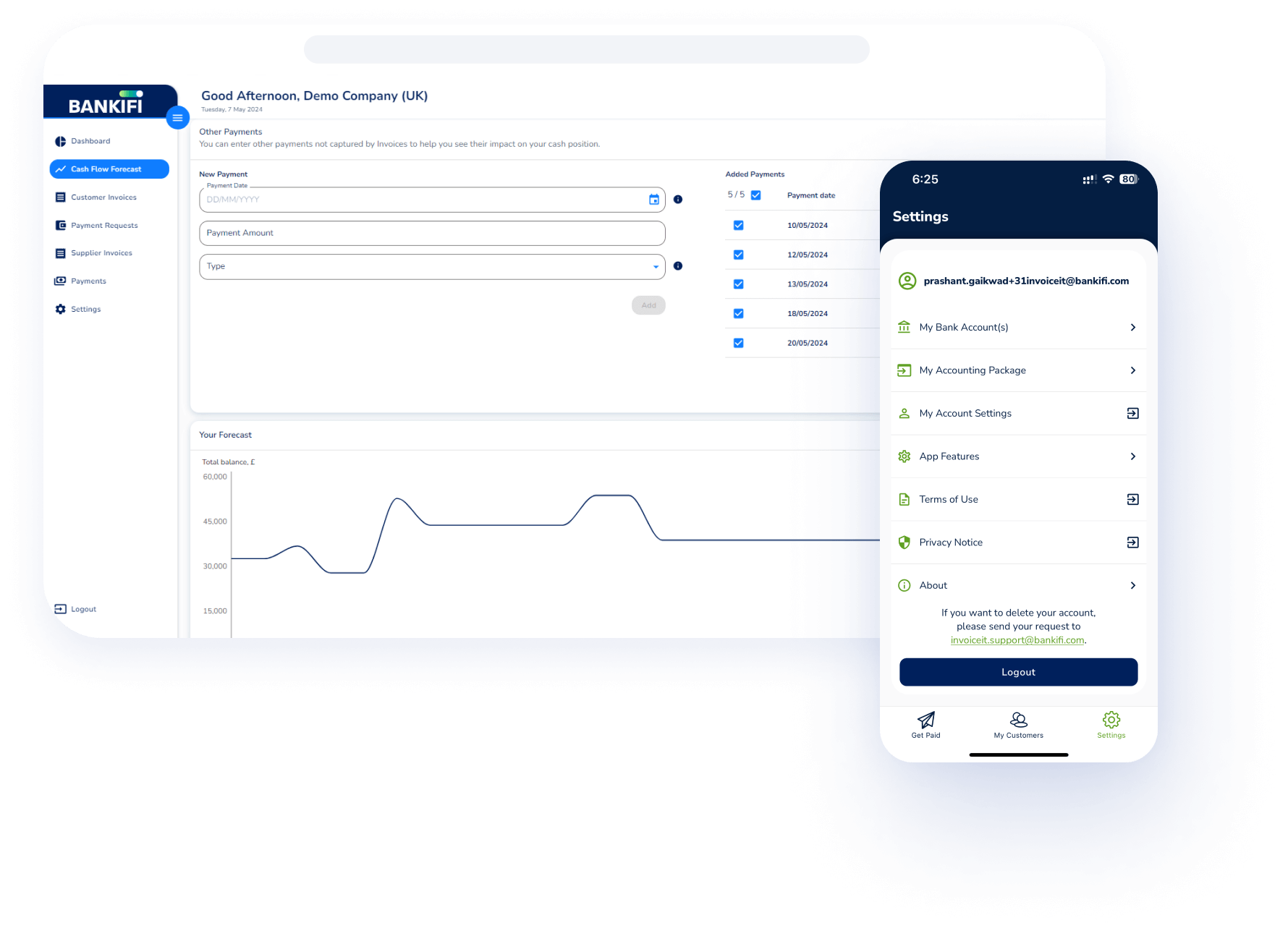

BankiFi’s innovative digital banking platform enables small businesses to manage their finances all in one place, deepening relationships by addressing businesses’ unique needs.

.png)

Our platform reimagines banks' relationships with their small business customers by offering an end-to-end platform that embeds banks within small businesses daily workflows.

.png?width=464&height=303&name=Rectangle%20313%20(1).png)

.png?width=464&height=303&name=Rectangle%20314%20(1).png)

.png?width=465&height=303&name=Rectangle%20315%20(1).png)

We offer a range of deployment models — just choose the one that’s right for your bank.

Choose a quick-to-market, standalone, co-branded version or embed our white-labelled services into your existing digital banking channels.

You can build your own customer experience on top of our business microservices or take our ready-made solution and white-label it as your own.

As we’re a regulated payment institution, you can also leverage our regulatory licence and utilise our end-to-end technology.

Our customer engagement team provide physical and digital services to differentiate from other propositions to gain a 360-degree view of small business finances.

.png)

The platform addresses key small business pain points that result in banks increasing revenues, reducing costs and growing lending opportunities.

54% of SME lending in the UK comes through brokers, and banks aren’t funding the £22 billion gap.

With 71% of SMEs not meeting eligibility criteria and 56% deemed too risky, our lending-as-a-service solution removes that risk and enables quick and easy lending.

Help small businesses access the funding they need to grow alongside a branded cash management platform where they can pay and get paid, all from within your digital channel.

In the UK, collecting money takes an average of 71 days when invoicing terms are 30 days. That equates to 54.6 million hours per year of businesses chasing late payments.

BankiFi enables banks to automate collections for your customers within your digital channel, reducing late payment days and hours spent on admin. Data from our solutions show small businesses are getting paid in just two days.

Automation is the answer, removing hours of admin time and the risk of human error.

BankiFi links bank accounts and accounting packages to automate matching and reconciliation, saving you time and money, and providing simple solutions for your customers.

It’s a common pain point for SMEs. As trusted advisors, you’re well placed to help, but you don’t have access to the technology or data to do so.

BankiFi holds the keys. Using data from bank accounts and accounting packages, BankiFi builds a live profile of your customers’ cash positions, allowing greater visibility to make better business decisions. All the while, financial intermediaries have access to invaluable data to shape future business decisions.

Often, processes happen across multiple applications, which can be a headache.

Instead, we make the workflow seamless. BankiFi enables the entire process from within a bank's digital channel, embedding you in their day-to-day activities.

This includes things like bookkeeping, linking accounting packages or, if they don’t have one, using bank-branded native invoicing services within the solution.

This creates relationship primacy between you and the SME and builds a customer profile that can support proactive lending and more.

Customers are often forced to use channels that don’t fit their needs, with no consistent experience across those channels.

We replace the siloed approach with an API-first solution. Our ‘gig to big’ model helps you to acquire customers at the earliest and cheapest point in their journey, so they never need to look elsewhere.

We’ve developed a unique platform that runs in any cloud and embraces consensual data sharing through APIs utilising virtual accounts, machine learning and reconciliation. This bank-grade technology is enabled by our industry-leading partners.

We partner with Microsoft and build all our technology on the preferred public cloud infrastructure for financial services providers

PayPoint offers secure mobile & online multi-channel payment solutions for businesses.

Redcompass are a specialist payment consulting and product company that sell and implement our solutions throughout Asia

Moneyhub is a data and payments fintech that provides open banking, open finance, and open data solutions.

SUBSCRIBE

.png)